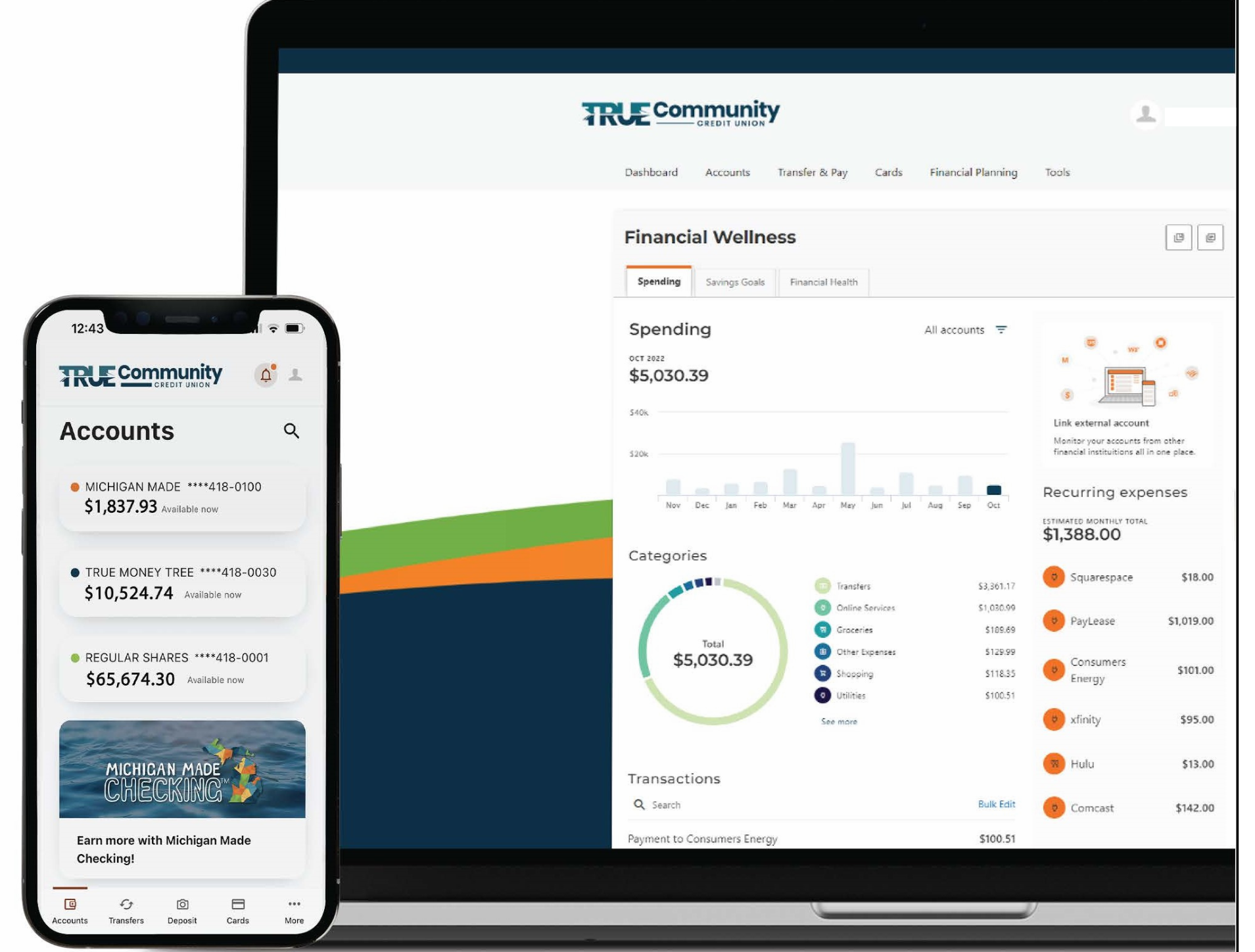

Access your account anytime, anywhere you go on your mobile device, tablet, or computer with TRUE Community Digital Banking.

Explore step-by-step instruction guides to help you navigate Digital Banking

Easy step-by-step instructions:

How to Register for Digital Banking

Digital Banking New User Registration

How to Find Your Account Number

Card Controls - Block and Unblock, Travel Notices, and Card Updater

Enroll now in Digital Banking.

Keep Michigan beautiful — switch to eStatements! It's hard to go wrong with eStatements: you do your part to reduce paper waste while helping yourself stay more secure.

- Reduce paper waste and help the environment

- Fast, free, and easy alternative to paper statements

- Receive email notice when new eStatement is ready

- Easier to retrieve information when needed

- Easily available online 24/7 through Digital Banking

- Reduce the chance of fraud and identity theft

- Simplify recordkeeping and eliminate storage hassles

- Easily access past statements

- View check images listed within your statement

- Easily view, search, save, download, and print online

If your card is lost or stolen, TRUE will issue you a new card. But what if you're not near a branch and need to have it mailed to you? We can now issue an instant digital card inside Digital Banking that you can push to your Apple or Google Wallet to use right away!

For existing and active cards:

1. Log in to Digital Banking and then click on Cards. (If logging in via the website, click Cards and then Card Controls.) Locate the card you want the details for.

2. Once you have located the card you want to view on the Card Controls screen, click View Details.

3. You will be prompted to choose a method to receive a verification code for multifactor authentication. You can select text, email, or call to receive the code.

4. Once the multifactor authentication has been successfully completed, the card view will change to show the complete information of the card, including the full card number, expiration date, and CVV.

For a new card not in hand, complete the steps above and then complete these additional steps:

1. Locate the card you want to use and select Finish Setup.

2. Select Card Activation.

3. Select Use Digital Card Display.

4. You will then be prompted for multifactor authentication. Once this has been completed, the card details will be visible and ready to be used for online purchases or to add to a digital wallet. The Card Status will say "Not set up" until the physical card is activated.

Push to Digital Wallet:

1. Log in to the TRUECCU mobile app and select the Cards button in the lower right corner to open the Card Management area.

2. Locate the card you would like to add and click Add to Google Wallet or Add to Apple Pay to start the process.

3. You will be prompted to verify the card you are wanting to add to your wallet. Select Continue (for Android) or Add to Apple Wallet to continue.

4. Enter the address information that is used for your billing on the card you selected and then click Verify.

DETAILS 4 Details NameDetails ContentParagraphTo open the popup, press Shift+EnterTo open the popup, press Shift+Enter Delete

Pay bills with ease using our free Bill Pay service in digital banking! If you need to make a one time payment or set up recurring payments, our Bill Pay feature can help you pay a company (utilities or cable), pay a person (friend or relative), or make a payment to another financial institution (loan payment or deposit).

With Bill Pay online you can:

- Schedule payments in advance

- Set up payment reminders

- Ensure payments are received on time

- Have all payee information in one convenient place

- Avoid paper clutter and reduce paper waste

- Relax knowing your bill payments are more secure than normal paper billing!

To get to the Bill Pay feature, log into digital banking and click on the Transfers & Pay tab, and then Bill Pay.”

Business Direct Pay

Now you have even more control and convenience when it comes to your business finances. We upgraded your business account with many new benefits that will work for you!

This new tool allows you to electronically:

- Add new payees quickly to make and track payments

- Pay/send payroll to employees with ease

- Set up recurring payments to save time each month

- Delegate payment tasks and keep control of final approvals

- Run customized reports with the information you need

Login to Digital Banking and click the Bill Pay tab to start today!

Sample ACH Direct Deposit Form:

This ACH direct deposit form (PDF) is a sample and is provided for guidance only. Consult your legal counsel prior to use.

- Personal financial management/budget tools

- Spending analytics

- Savings goals and tracking

- Credit score and monitoring with SavvyMoney

- Loan payoff calculator

- Ability to set account distributions for incoming payroll

Enhanced Navigation and Account Management:

- At-a-glance dashboard that can be customized to your preferences with the ability to “nickname” your accounts

- Send and receive money with people who use Zelle® in their banking app, even if they don’t bank with TRUE Community Credit Union*

- Advanced Bill Pay features and scheduling

- Reorder checks and ability to place stop payments

- Apply for skip-a-payment on your loan

- Access eStatements on mobile

Communication:

- Real-time live digital support via conversational banking with TRUECCU representatives

- Send questions to our team via a safe, secure message system

- Set up customized alerts – via push notifications, email or SMS text (Go to Settings – Alerts)

Account Aggregation:

- Link to accounts at other financial institutions for full account aggregation

- Ability to set up viewing of Investment Accounts to monitor activity Note: Other institutions must allow permissions of this feature

Additional Security:

- Enhanced card control features, with the option to easily notify merchants you have tied to your card in the event your card number changes

- Dispute feature to report an error or fraudulent activity

- Set travel notifications