Ready to cash in while boosting your purchasing power? Earn rewards — while you save with no annual fee.

Earn More with your TRUE Rewards Credit Card

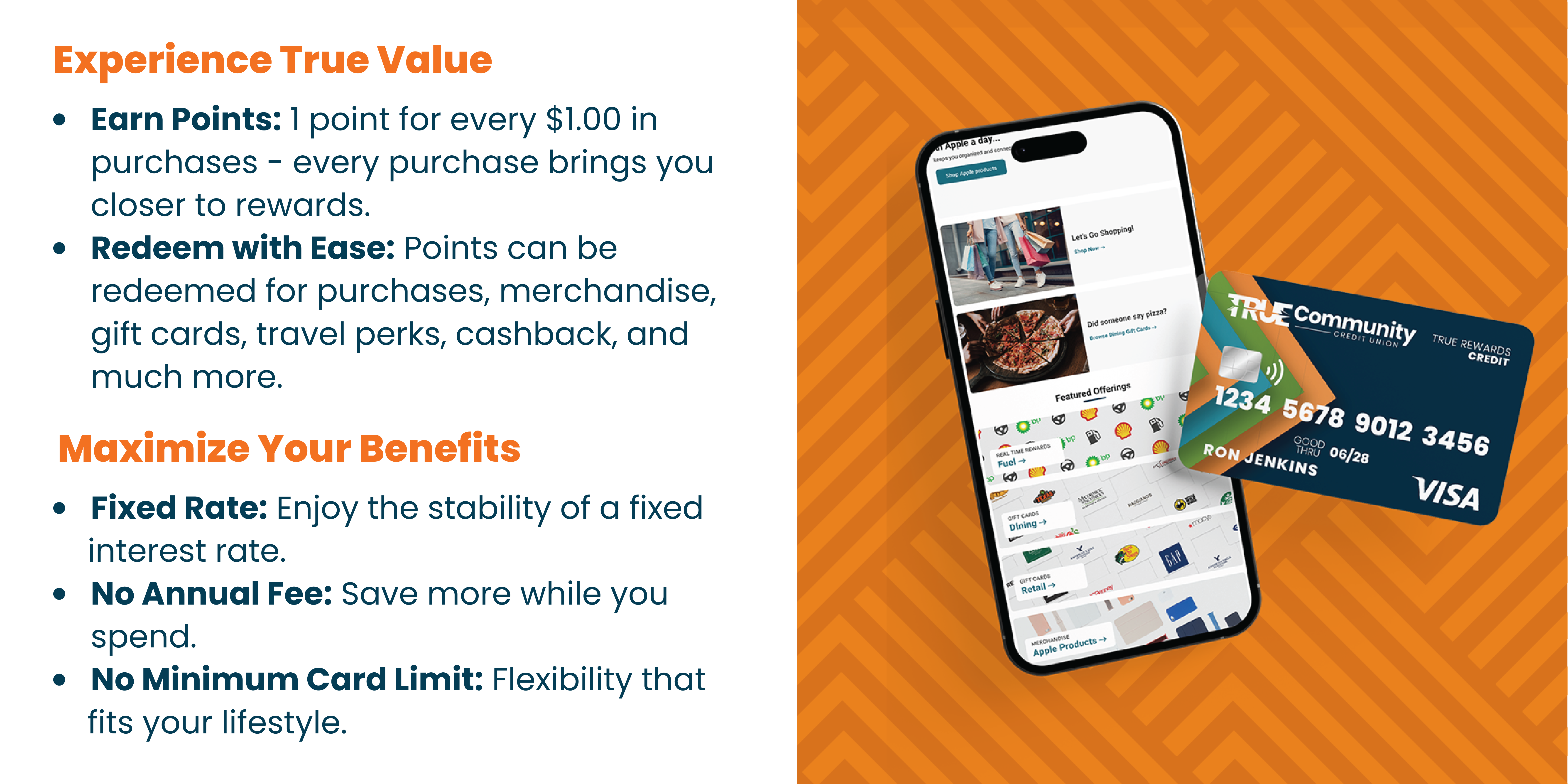

Visa TRUE Rewards Credit Card

Are you currently a member of TRUE Community Credit Union?

Experience the perks of the TRUE Rewards Credit Card!

Earn points on everyday purchases, and redeem them for purchases, merchandise, gift cards, travel perks, cashback, and much more. Plus, receive exclusive discounts, and enjoy peace of mind with top-notch security features.

- Boost your purchasing power

- Competitive, fixed APR

- Merchandise & cash back reward options

- No annual fee

- Credit limits starting at $500

- Low monthly payments

- Earn 1 point for every $1 in purchases

- Redeem points for merchandise, cash back, and more!

- No cap to points you can earn

- Shared points can be managed in Digital Banking

We’ve made it simple—from application to funding!

- Apply Online

Start your application right here on our website—quick, secure, and available 24/7. - Get a Fast Decision

We’ll send your loan decision directly to your phone or inbox. - Provide Required Information

Easily upload your documents if needed: - Recent pay stubs (for income verification)

- Statements (if consolidating debt)

- Vehicle info (if you're buying—year, make, model, VIN, and mileage)

- Close Electronically

Review and sign your loan documents securely through DocuSign—no need to visit a branch. - Receive Your Funds

Once signed, we’ll disburse your loan.

Visa TRUE Rewards Credit Card

Are you currently a member of TRUE Community Credit Union?

Borrowers must be of legal age to apply for a loan.