SAVE THE DATE: Please join us for our Annual Meeting of the TRUECCU Membership on Thursday, April 23, 2026.Petition packets will be available beginning Monday, January 12 at 10 a.m. for anyone interested in becoming a nominee for the TRUE Community Credit Union Board of Directors.Members interested in a board elective position may apply using the elective office application and petition forms. To receive a packet or for additional information, please contact Brittany Rumple, Executive Business Partner & Internal Communications Specialist, at [email protected], or visit our Main Office located at: 1100 Clinton Rd. Jackson, MI 49202. All completed petitions must be returned no later than Monday, February 21 at 5 p.m. |

Interested in learning how to send and receive money safely with Zelle, Venmo, and Cash App? Registration for Cash Apps 101 is open! Click here to register for this virtual session.

The 2025 Year in Review is now available. Click here!

{beginAccordion h2}

Events

|

TRUECCU Financially Fearless Series |

Thursday, February 26; 12:00-12:30 p.m. |

Virtual -- Register here |

Topic: Cash Apps (Zelle/Venmo/Cash App)--Learn how to send and receive money safely |

|

TRUECCU Financially Fearless Series |

Tuesday, March 31; 12:00-12:30 p.m. |

Westland and Clinton |

Topic: Fraud Prevention--Spot phishing, smishing, and vishing before they get you |

|

Annual Membership Meeting |

Thursday, April 23 |

Clinton |

|

|

TRUECCU Financially Fearless Series |

Monday, April 27; 12:00-12:30 p.m. |

Virtual |

Topic: Investing Basics--Discover simple ways to start growing your wealth |

Newsletters

The Arrow - February 2026 Stay up to date with TRUECCU and all the latest happenings with our monthly eNewsletter!

News

View our press releases below:

Chrissy Siders, President and CEO of TRUE Community Credit Union, Wins Prestigious ATHENA Award

JACKSON, MI, DECEMBER 9, 2025 – TRUE Community Credit Union is proud to announce that President and CEO Chrissy Siders has been named the recipient of 2025 Jackson County ATHENA Leadership Award.

The ATHENA Award honors individuals who strive toward the highest level of personal and professional accomplishment, excel in their chosen field, devote time and energy to their community in meaningful ways, and forge paths of leadership for women to follow. The award was one of several community awards presented by the Jackson County Chamber of Commerce during their Night of Distinction.

“I am deeply humbled to receive the ATHENA Award,” said Siders. “This recognition is not about accolades, but about the legacies we leave and the life lessons we learn and apply. My journey has been shaped by moments of loss and resilience, teaching me to live with purpose, choose joy, and lead boldly. I hope my story inspires others to work hard, embrace courage, foster belonging, and create spaces where hope can rise from ashes. May we all strive to live intentionally, love deeply, and make a meaningful difference in the lives of others.”

Presented to leaders across professional sectors, the ATHENA Leadership Award’s rich history, international scope, and focus on mentorship distinguishes it as one of the most prestigious leadership awards one can receive.

“Chrissy Siders’s leadership at TRUE Community Credit Union and throughout the community reflects the heart of ATHENA— modeling the ideals of excellence, service to community, and intentional mentorship,” said TRUECCU Chief Community Impact Officer Sarah Ermatinger. “Her recognition as the 2025 ATHENA Award recipient simply affirms what we witness every day in her leadership.”

TRUE Community Credit Union congratulates Chrissy Siders on this well-deserved recognition and celebrates her ongoing contributions to the community and the advancement of women in leadership.

Chrissy Siders, TRUECCU President and CEO (left) and 2025 ATHENA Award recipient, and TRUECCU Chief Community Impact Officer Sarah Ermatinger.

TRUE Community Credit Union and Nuestra Comunidad Team Up to Support Local Students

TRUECCU provided $10,000 in scholarships for students to invest in their education

JACKSON, MI, DECEMBER 4, 2025 –TRUE Community Credit Union is proud to have partnered with Nuestra Comunidad for a third year to provide $10,000 in scholarships for local students.

“The impact of these awards continues to reverberate throughout our community, uplifting our youth and inspiring those who follow behind them,” said Leticia Albarran, Board Chair of Nuestra Comunidad. “We are honored to collaborate with an organization like TRUECCU, who share our commitment and vision in empowering and investing in our local community and students through meaningful and purposeful initiatives! We cannot wait to see where these students' success takes them!”

Applicants had to meet eligibility requirements, which included being a recent graduate of a Jackson or Lenawee county school or have a GED, having one or both parents of Hispanic or LatinX decent, and being enrolled in or planning to enroll in a 2–4-year institution, trade or apprentice program.

2025 Recipients of the Nuestra Comunidad Scholarships:

- Daniel Orozco

- Daniela Orozco

- Juan Rayas Jr.

- Andrew Salazar

- Giovanna Sereno

- Maritza Zavala

Photo includes the scholarship recipients, along with Leticia Albarran, Board Chair of Nuestra Comunidad; Janelle Merritt, TRUECCU Director of Community Partnerships; and Canis Arbrouet, TRUECCU Vice President of Facilities and Nuestra Comunidad Board Treasurer.

TRUE Community Credit Union Hires Two Vice Presidents

JACKSON, MI, OCTOBER 1, 2025 – TRUE Community Credit Union is proud to announce that Darcey Eagen has joined the credit union as Vice President of People, and Jill Johnson has joined as Vice President of Consumer and Real Estate Lending.

Eagen has 25 years of experience leading human resources in the health care and banking industries, and has guided teams in talent acquisition, employee and labor relations, HR strategy and mergers and acquisitions. In alignment with TRUECCU’s values, Eagen currently serves on the board of LifeSpan, which provides valuable resources for those with disabilities.

“In an organization focused on people and curating an exceptional workplace for our team, the VP of People role is a critical champion,” said TRUECCU Chief People Officer Heather Harback. “Darcey not only brings a solid track record in her field, but she’s demonstrated a shared commitment to our values and the creation of legacy-defining moments for those we serve alongside. I’m excited for the impact she will have across our organization.”

Johnson has over three decades of lending experience, 28 years of proven leadership, and 24 years of dedicated service within the credit union industry. She is passionate about professional development, leadership, and delivering exceptional member service, and thrives on building strong, collaborative teams and fostering meaningful connections that extend not only from team member to team member, but to every member served.

“Jill brings extensive expertise and a passion for empowering communities through mortgage, home equity, and consumer lending solutions,” said TRUECCU Chief Growth and Lending Officer Valerie Moskal. “As we continue to grow and innovate, her strategic vision will help us to provide access to even more lending solutions for our members and the communities that we serve.”

Serve It Forward Pickleball Scramble to Benefit Local Family

Community rallies around pickleball for a cause

JACKSON, MI, SEPTEMBER 18, 2025 – The Serve It Forward Pickleball Scramble, scheduled for Friday, Oct. 24, at Crossroads Pickleball in Jackson, aims to support the Garrett family’s efforts to build a safe, accessible home for their daughter, 11-year-old Kimmie.

Over the past year, the Garretts, a family of six, have faced immense challenges as Kimmie battled a life-threatening illness that resulted in the loss of her limbs. The Garretts' current home is no longer suitable for Kimmie’s new mobility needs, and a more accessible living space is essential for her continued recovery and well-being.

This scramble offers an opportunity for players, spectators, and the community to come together to foster an unforgettable experience while contributing to a significant cause.

Tournament Schedule and Divisions:

- Date and Venue | Friday, Oct. 24 at Crossroads Pickleball in Jackson

- Recreational Scramble | 8:30 a.m. – 12:00 p.m.

- Lunch | 12:00 p.m. – 12:30 p.m.

- Seasoned Scramble | 12:30 p.m. – 4:00 p.m.

Event proceeds will help provide something truly meaningful to the Garrett family—a thoughtfully designed, accessible home filled with care and community spirit.

Become a sponsor and learn more about the Garrett’s journey at https://www.trueccu.com/serve-it-forward-.html

TRUE Community Credit Union’s Financial Education Department Honored with Two National Awards

TRUECCU’s Community Impact team also contributed to the team honors

JACKSON, MI, SEPTEMBER 16, 2025 – TRUE Community Credit Union's Financial Education Department received two national awards from the Credit Union Financial Education Network (CUFEN) for the 2024-2025 school year.

The department secured second place in both the "Youth Presentations" and "Youth Reached" categories for credit unions of its asset size. These accolades highlight the department's commitment to enhancing the financial education of individuals through engaging workshops, hands-on tools, and personalized guidance.

“The Financial Education team continues to shine in both volume and quality of presentations to children,” said Janelle Merritt, TRUECCU Director of Community Partnerships. “Just this month, a parent shared that after our visit to their child’s classroom, their child was so inspired they began asking to mow lawns and take on odd jobs to earn and save money. Moments like these remind us why we do this work. It’s not just about teaching financial concepts – it’s about planting seeds of possibility. We’re honored to play a small role in helping the next generation dream big, work hard, spend wisely, and save for the future.”

The awards were presented at the CUFEN Conference, held from July 27 to July 29 in Philadelphia, which brought together credit union professionals from across the country to share strategies and celebrate achievements in financial education.

Michigan led the nation in total youth presentations during the reporting period, underscoring TRUECCU's contributions in achieving this milestone, as well as the commitment of credit unions across the State and the support of the Michigan Credit Union League.

TRUECCU Financial Education 2024-2025 School Year Wrap Up

Youth Reached: 9,469

Presentations Made to Youth: 574

TRUE Community Credit Union Announces Internal Promotions of Two Senior Leaders

JACKSON, MI, JULY 15, 2025 – TRUE Community Credit Union is excited to announce the promotion of two leaders: Jennifer Hodges to Vice President of Marketing, and Maranda Kemler to Vice President of Risk Management.

Hodges has been with TRUECCU since 2020 as Director of Marketing. She has been responsible for the strategic development and execution of marketing initiatives, overseeing integrated campaigns, analyzing market trends to drive growth and visibility, and ensuring alignment with TRUECCU goals and brand identity. Hodges’ promotion reflects a proven track record of success, a deep understanding of market dynamics, and a commitment to data-driven strategies that enhance brand equity and member engagement. With her promotion to Vice President of Marketing, she will drive high-level marketing initiatives, foster innovation across all channels, and deepen alignment throughout the credit union.

“We are excited to announce the promotion of Jennifer Hodges to Vice President of Marketing,” said Sarah Ermatinger, Chief Community Impact Officer. “Jennifer's commitment to driving the best member experience through our marketing channels and dedication to TRUE Community Credit Union has been instrumental in advancing our mission to cultivate legacy-defining moments for the people and places we serve. We are excited to see how Jennifer will continue to inspire excellence and innovation in this new role.”

Kemler has been with TRUECCU since 2013, starting as a part-time teller before moving to a full-time position in the Audit and Compliance Department. She has most recently served as Director of Risk Management, where she was responsible for the strategic identification, assessment, and mitigation of risks across all areas of credit union operations. This includes leading enterprise risk initiatives, ensuring compliance with regulatory standards, and developing policies that safeguard the organization from financial, operational, and reputational threats. Kemler has demonstrated strong leadership, deep expertise in risk oversight, and the ability to manage complex risk landscapes. As Vice President of Risk Management, she will be involved in greater collaboration with executive leadership and the board of directors, contributing to long-term planning and ensuring the credit union’s risk posture aligns with its overall growth objectives.

“We are proud to recognize Maranda Kemler’s outstanding leadership and commitment to the members and employees of TRUE Community Credit Union,” said Brandi Cole, Chief Risk Officer. “Maranda’s deep expertise in risk management, her passion for the credit union industry, and her dedication to our mission have been critical in strengthening the foundation of our organization. We look forward to the innovation and collaboration she will bring as Vice President of Risk Management, ensuring we continue to serve our members with security and confidence.”

Pictured: Jennifer Hodges (left), Maranda Kemler (right)

TRUE Community Credit Union Announces Internal Vice President Promotion

JACKSON, MI, JUNE 11, 2025 – TRUE Community Credit Union is excited to announce the promotion of Chris Chaney to Vice President of Finance.

Chaney has been with TRUECCU for six years, most recently as Director of Business Intelligence where he was responsible for leading TRUECCU’s data strategy to ensure business decisions were driven by accurate, timely, and actionable insights. In his new role as VP of Finance, Chaney will oversee the credit union’s financial health and strategy, and support key business decisions.

“Chris has been incredibly impactful across every corner of the credit union, bringing insight, innovation, and integrity to the many teams and projects he supports,” said Lance Schnitkey, TRUE Community Credit Union Chief Financial Officer. “His promotion to Vice President of Finance is a well-earned advancement, and we’re thrilled to see the impact he’ll make with a dedicated focus on financial strategy and growth. We’re confident that under his leadership, our financial future is in exceptional hands.”

TRUE Community Credit Union Announces 2025 Scholarship Recipients

Scholarships of $1,000 each were awarded to eight students

JACKSON, MI, JUNE 3, 2025 – TRUE Community Credit Union is proud to invest in the legacy-defining moments of local students to further their education and is excited to announce the 2025 scholarship recipients.

“We are so proud to be able to support our mission by awarding eight scholarships to students as they begin to step into their next legacy-defining moment,” said Sarah Ermatinger, Chief Community Impact Officer. “These students captured the essence of financial well-being and what it means to be prepared for their future. We wish you the best, and may your journey be filled with success, joy, and endless opportunities.”

TRUE Community Credit Union awarded eight students with a $1,000 scholarship each. This year, students graduating high school in the 2025 graduating class and students over the age of 23 that have a high school diploma or General Educational Development (GED) and are now seeking a degree or returning to complete their degree had the opportunity to apply.

“There’s nothing more rewarding than seeing students connect the dots when it comes to financial wellness,” said Lorrie Detloff, Financial Education Coordinator. “It’s an honor for our team to not only educate but also support students' next steps through scholarships that invest in their future.”

TRUE Community Credit Union is dedicated to maintaining 30+ years of serving schools to promote the Partnership in Education program and embraces the chance to work with youth around the state. Students will be able to apply for scholarships in the next school year beginning January 2026.

The recipients of the 2025 Scholarships are:

- Jonathan T, Western High School

- Allison M, Addison High School

- Seth M, Jackson High School

- Robert A, Grass Lake High School

- Parker M, Jackson High School

- Henry B, Homeschool

- Nasier R, Concord High School

- Elle V, Lumen Christi Catholic School

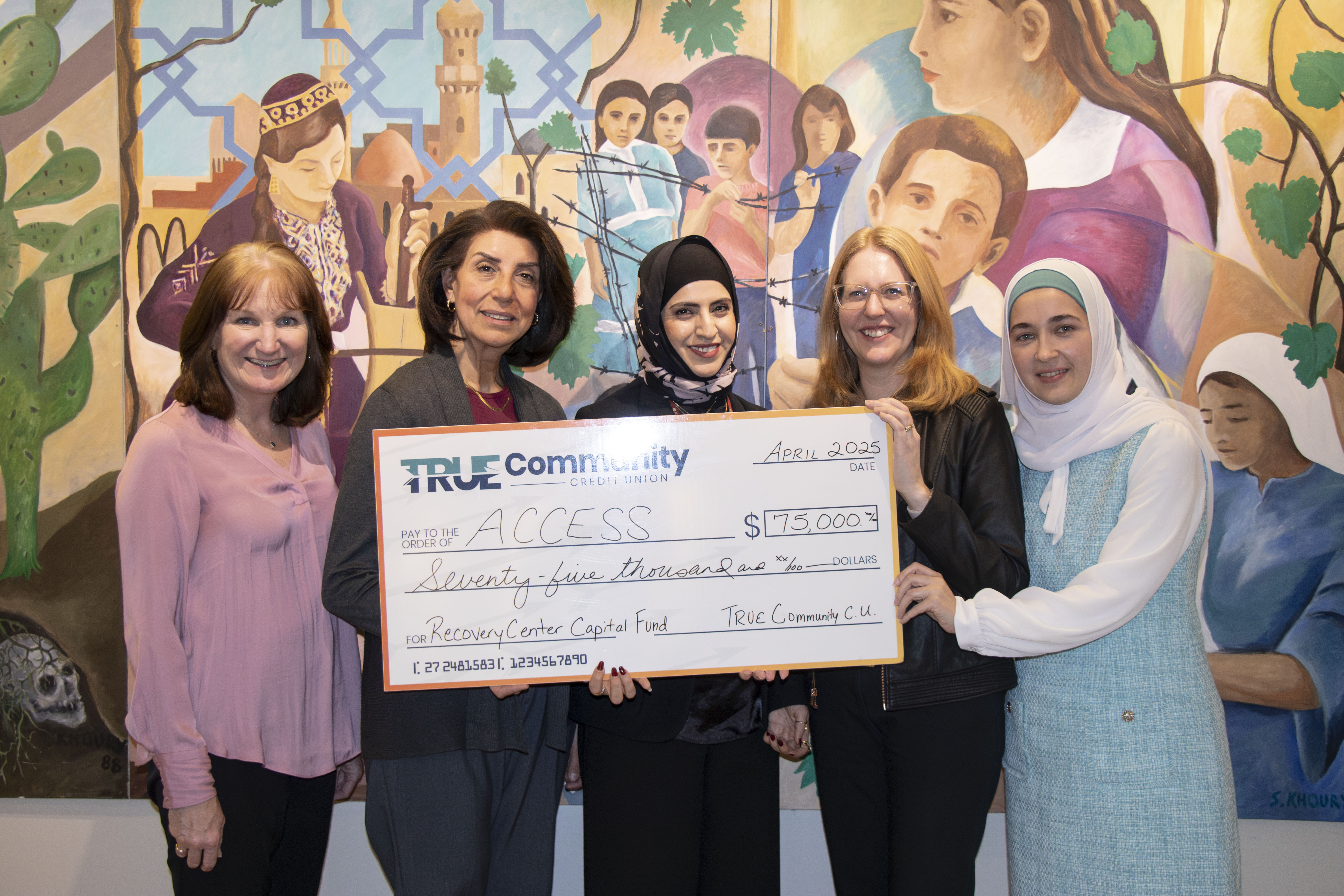

TRUE Community Credit Union Donates $75,000 to Arab Community Center for Economic and Social Services

Donation will help expand mental health and substance use disorder recovery services for families in the community.

JACKSON, MI, APRIL 23, 2025 – TRUE Community Credit Union is proud to announce a significant commitment to the Arab Community Center for Economic and Social Services (ACCESS) efforts to establish a recovery center for substance use disorders, pledging $75,000 over the next five years.

“At TRUE Community Credit Union, we believe in the power of community and the importance of supporting organizations that make a meaningful impact,” said Chrissy Siders, President and CEO of TRUE Community Credit Union. “Our donation to ACCESS is a testament to our commitment to fostering growth, inclusivity, and opportunity for all. We are proud to partner with ACCESS and contribute to their vital work in empowering individuals and families in the community through legacy-defining moments.”

The ACCESS Recovery Center will be located in Dearborn with plans for a state-of-the-art, three-story building encompassing 51,000 square feet. It is designed to offer a community-centered approach to prevention, education, and healing. The center will house a wide range of services, including a crisis stabilization unit, inpatient detoxification, short-term residential care, and wraparound outpatient treatment. Additionally, psychiatric services will be available to ensure comprehensive care for all patients.

A key aspect of the ACCESS Recovery Center is its commitment to being linguistically and culturally inclusive. The center will focus on the unique needs of the Arab American community, which ACCESS has served for over 50 years. This dedication to inclusivity ensures that all individuals seeking help will receive the tailored support they need.

“At ACCESS, our mission is to meet people where they are—with compassion, dignity, and a full spectrum of care,” said May Ann (Miyan) Sobh, Development Director at ACCESS. “The ACCESS Recovery Center is more than a treatment facility; it’s a place for healing, hope, and real transformation, accessible to all who need it. We are so pleased to have TRUE Community Credit Union be a part of this important initiative.”

The ACCESS Recovery Center represents a significant advancement in the fight against addiction and the promotion of holistic recovery in southeast Michigan. Through this partnership, TRUE Community Credit Union reaffirms its commitment to community well-being and the importance of accessible mental health resources.

TRUE Community Credit Union offers membership to anyone who lives, works, worships, or studies in Michigan, with 15 branch locations—including three in Metro Detroit—to serve its members.

Learn more about ACCESS at ACCESSCommunity.org. Learn more about TRUE Community Credit Union at TRUECCU.com.

PICTURED (left to right): Mary Kerwin, TRUECCU Community Impact Specialist; Brigitte Fawaz-Anouti, ACCESS Social Services Main and Special Projects Director and TRUECCU Board Member; May Ann (Miyan) Sobh, ACCESS Development Director; Janelle Merritt, TRUECCU Director of Community Partnerships; and Yasameen Mahmood, ACCESS Development Officer.

TRUE Community Credit Union Wins Prestigious

Diamond Award for Marketing Excellence

The award was for a video highlighting their dedication to positive community impact

JACKSON, MI, MARCH 26, 2025 – TRUE Community Credit Union is thrilled to announce it was among 180 credit unions nationwide named as a winner of the prestigious Diamond Award – the Marketing, PR & Development Council’s annual competition for marketing excellence. TRUE Community Credit Union received the award for the CU Kind Day video in the Video Non-Commercial – Single category. This recognition highlights TRUE Community Credit Union's unwavering commitment to exceptional community support and engagement.

The video not only celebrated their commitment to kindness and service but also hoped to inspire others to join in recognizing the importance of community support. It was created during CU Kind Day, October 14, 2024, where team members of TRUE Community Credit Union showcased their passion for fostering connections and enhancing the well-being of the communities they serve. TRUECCU gave back to 12 organizations while also spreading various acts of kindness with community partners.

Each year, the Marketing, PR & Development Council of America’s Credit Unions recognize creative excellence and outstanding results in credit union marketing. The awards celebrate the best in the industry, showcasing the remarkable efforts of credit unions that strive to enhance their marketing initiatives and connect with their members effectively.

TRUE Community Credit Union offers 15 branch locations to serve members throughout Jackson, Ingham, Wayne, and Washtenaw counties. Their mission is to cultivate legacy-defining moments for the people and places they serve for generations to come.

Watch the award winning video on YouTube at https://youtu.be/jTnVlIUSnlA?si=IHEBgsmrmD1rw213

TRUE Community Credit Union Announces Winners of 2024 Employee Awards

18 employees were chosen by their teammates to best represent the credit union values.

JACKSON, MI, MARCH 12, 2025 – TRUE Community Credit Union is proud to announce the winners of the 2024 Employee Awards. These awards recognize outstanding contributions made by our team members the previous year that best represent the credit union values. Team members were nominated by their peers and nominees were voted on by the entire credit union staff.

“These awards shine a light on employees who use their strengths consistently to embody our values and bring them to life in service of our members, our communities, and for their fellow teammates,” said Heather Harback, TRUECCU Chief People Officer. “We’re all better having the opportunity to work alongside our award winners, and our annual awards are a great opportunity for the entire organization to nominate and recognize the stellar work being done by their colleagues.”

Awards were presented in three distinguished categories during TRUE’s Family Reunion, a day of employee education and celebration, on Monday, February 17: The Value Champion Awards, The Pillar Awards, and the Employee of the Year Award. The winners of each category are the following:

The 2024 Values Champion Awards:

- Perry Nichols and Charlye Schultz – Joy: Making joy common in uncommon places.

- Takara Schupbach – Stewardship: Exceptional stewardship of all interests entrusted to the credit unions care.

- Dan Stanton – People: Focuses on people over profit, process and product.

- Kendall Long and Faith Minix – Empower: An empowered organization founded in experience-focused solutions.

- Josiah Miles – Gratitude: Unwavering faith in people and the virtues of gratitude and humility.

- Carrie Walters – Feedback: Two-Way feedback graciously welcomed and respectfully given.

- Josh Pero, Gaje Maher, and Dan Stanton – Curiosity: Relentless curiosity.

- Jo Koerkel – Opportunity: A deep-seated appetite to realize opportunity through innovation.

The 2024 Pillar Award Nominees:

- Josh Pero and Josiah Miles – Member-Centered: This individual maintains a clear and consistent focus on member service/ experience throughout their work.

- Josiah Miles and Heathor Balazy – Community-Minded: This individual is fully committed to volunteering their time and talents in the community.

- Shannon Daidone – TRUE-Team Focused: Contributing to a great place to work is this individual's jam.

The 2024 Employee of the Year:

- Chris Chaney – Employee of the Year: Someone who demonstrates the very best of TRUECCU and our culture consistently.

These team members reflect the values the credit union upholds and their commitment to members and community. TRUE Community Credit Union is proud to celebrate their accomplishments and looks forward to another year of excellence.

TRUE Community Credit Union is a team-oriented organization that builds on the strengths of its team members. There are 15 branch locations to serve members located in Jackson, Ingham, Washtenaw, and Wayne counties.

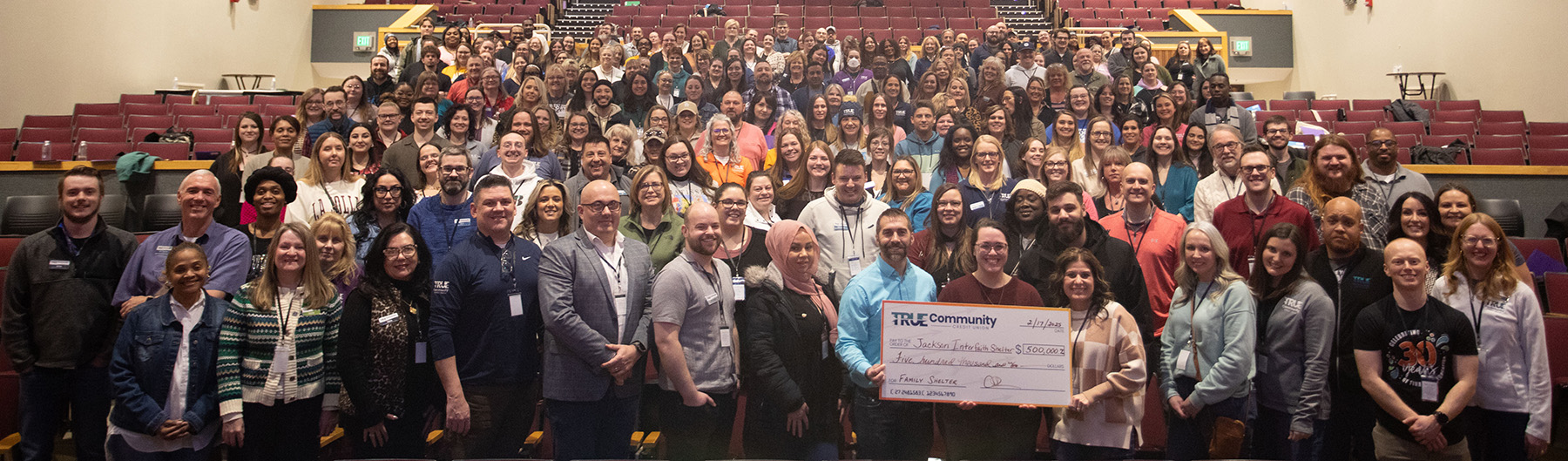

TRUE Community Credit Union Donates $500,000 to Jackson Interfaith Shelter

The donation will help build a new family shelter for those facing homelessness.

JACKSON, MI, FEBRUARY 26, 2025 – TRUE Community Credit Union is proud to donate $500,000 to the Jackson Interfaith Shelter over the next five years. The donation is part of the Jackson Interfaith Shelter's Capital Project to build a new facility dedicated to families to provide safe, stable housing and support services for those facing homelessness.

“We are honored to partner with the Jackson Interfaith Shelter to build a safe haven for families in need,” said Chrissy Siders, President and CEO of TRUE Community Credit Union. “This is more than a donation – it’s a legacy-defining moment, a commitment to writing a new chapter in the life stories of those seeking hope, stability, and a place to call home.”

The Jackson Interfaith Shelter is a non-profit organization whose mission is to work with people experiencing homelessness by providing emergency shelter, prepared meals, and assisting with other physical, emotional and spiritual needs when possible.

“Words cannot fully express our gratitude for this incredible gift,” said Steve Castle, Chief Executive Officer of Jackson Interfaith Shelter. “Every day our team sees firsthand the unimaginable struggles families are going through as we walk through this difficult season of life with them. Many of them feel unseen and overlooked. TRUE's gift is a resounding acknowledgement that they are seen and that they matter. Thank you for leading by example in the Jackson community and beyond.”

Jackson Interfaith Shelter was founded in 1974 by Beverly Garges and a variety of other faithful individuals and religious organizations as a Christian organization based on biblical principles with its original goal of serving men experiencing homelessness due to chronic alcoholism. Today they have expanded services to include women and families, and the shelter currently has 76 beds for men, women, and families.

TRUE Community Credit Union offers 15 branch locations to serve members throughout Jackson, Ingham, Wayne, and Washtenaw counties. Our mission is to cultivate legacy-defining moments for the people and places we serve for generations to come.

Learn more about the Jackson Interfaith Shelter at InterfaithShelter.com. Learn more about TRUE Community Credit Union at TRUECCU.com.

[PICTURED] TRUE Community Credit Union presented a check for $500,000 to Steve Castle, Chief Executive Officer of Jackson Interfaith Shelter.

TRUE Community Credit Union to Build a New Livonia Branch,

Replacing the Current Plymouth Road Location

The new branch will enhance member experience and convenience.

JACKSON, MI, JANUARY 15, 2025 – Construction on a new TRUE Community Credit Union branch in Livonia is scheduled to begin early 2025. This project marks a significant investment in the Livonia community, enhancing service capabilities and providing modern facilities for members.

The new branch construction will take place behind the current branch, located at 36525 Plymouth Rd., and will not disrupt regular service at the current branch.

The new building, with a total of 2,930 square feet, is expected to be completed by the end of 2025 and will feature two self-serve kiosks inside and three Interactive Teller Machines (ITMs) located outside. As part of the project, one of the current ITMs will be relocated to the south end of the parking area for easy member access during construction as the existing canopy will be demolished, followed by excavation work shortly after.

TRUE Community Credit Union offers 15 branch locations to serve member with three located in Metro Detroit.

TRUE Community Credit Union Is Thankful to Give Back to Our Community

Community involvement isn't just a responsibility, it's in our DNA

JACKSON, MI, November 21, 2024 – As the holiday season approaches, TRUE Community Credit Union is thankful to be able to give back to the communities we serve. Our dedication to making a positive impact was especially evident on CU Kind Day. This annual event is a time for credit unions to give back, reinforcing our core values and the belief that supporting our communities is an integral part of our identity.

Community involvement isn't just a responsibility, it's in our DNA. Through various initiatives, volunteer efforts, and partnerships with local organizations, TRUE Community strives to uplift those around us and create a lasting difference.

By participating in CU Kind Day, our team showcased their passion for fostering connections and enhancing the well-being of those we serve and those who serve our communities. We not only celebrate our commitment to kindness and service but also inspire others to join us in recognizing the importance of community support.

This year on CU Kind Day, our team proudly supported 12 organizations while spreading acts of kindness throughout our communities.

Who we supported for CU Kind Day 2024:

- Alpha House – Ann Arbor, MI

- Our team donated toothpaste, laundry soap, dish soap and gift cards from the wish list

- Jackson Interfaith Shelter – Jackson, MI

- Our team donated 16 twin sheet sets, men’s and women’s razors, laundry pods, and men’s and women’s deodorant

- Salvation Army – Jackson, MI

- Donated wish list supplies

- Huron Valley Humane Society – Ann Arbor, MI

- Donated food, toys, kitty litter, and bought donuts and cider for the staff. Team members also donated gently used towels

- Young People of Purpose – Jackson, MI

- Donated funds and time for the community garden project

- Funds donated to

- SOAR Café

- Local spaghetti dinner fundraiser for a Vandercook Lake area community member fighting cancer

- Girls on the Run

- Local Jackson family in need

- Grass Lake Fire Department

- Brooklyn Food Pantry

- Act of Kindness:

- Made blankets to donate

- Gave money to shoppers at grocery stores

Included is a link to the video that captures what giving back to our communities truly means to us. Original video can be provided upon request.

Watch our CU Kind Day video on YouTube at https://youtu.be/jTnVlIUSnlA?si=CDjd9IU77r03oPKd

TRUECCU Partnered with Nuestra Comunidad To Provide $20,000 For Scholarships

TRUE Community Credit Union presented a check at Jackson’s Hispanic Heritage Festival

JACKSON, MI, September 26, 2024 – TRUE Community Credit Union is proud to support local students by partnering with Nuestra Comunidad to provide $20,000 for scholarships.

“Investing in our local students is an investment in legacy-defining moments as well as our community’s future,” said TRUECCU President and CEO Chrissy Siders. “We’re proud to partner with Nuestra Comunidad to provide $20,000 in scholarships, partnering with, and empowering the next generation to write a life story that stretches beyond their imaginations.”

Applicants had to meet eligibility requirements, which included being a recent graduate of a Jackson or Lenawee County school, having one or both parents of Hispanic or LatinX decent, and being enrolled in or planning to enroll in a 2–4-year institution, trade or apprentice program.

TRUECCU presented the check to the 2024 recipients during the Jackson Hispanic Heritage Festival on Saturday, September 14.

TRUE Community Credit Union Assists Interns with Financial Literacy Requirements

TRUECCU partnered with Grow Jackson Urban Agriculture

Intern Workforce Development Program

JACKSON, MI, September 24, 2024 – TRUE Community Credit Union was excited to partner with Grow Jackson and their Urban Agriculture Intern Workforce Development Program this summer. TRUECCU provided financial literacy pieces to accompany the Roots of Success Curriculum, a ten-module program that the interns must complete.

“Our TRUE team members, Sarah Fuller, Financial Education Coordinator, and Juarie Jordan, Member Advisor, were excited to invest in these young adults by providing education and coaching to assist them in developing life-long money management skills,” said TRUECCU Financial Education Manager Kelly Hatler. “Our partnership with Grow Jackson has been a great opportunity to support the needs of our community and cultivate legacy-defining moments for the interns as they set goals and navigate decisions regarding their career path and financial future.”

The TRUE team members provided four financial education lessons for the interns that included goal setting, budgeting, credit, and loan fundamentals; and provided additional information and resources TRUE offers. The Grow Jackson interns also received four one-on-one coaching sessions to help guide them toward a $1,000 savings goal. Those who were able to reach the goal at the end of the internship received a $1,000 match from TRUE.

“Having this incredible support from TRUE Community Credit Union made an overwhelming difference for our program,” said Grow Jackson Founder and Executive Director Jacob Inosencio. “Many of the interns in the program this summer had a job and an income for the first time. Getting exposure to these formative financial literacy education opportunities made a tremendous impact on their habits and their future decisions. This was truly a defining moment in their lives and we are so grateful to TRUE for their investment in the future of our intern team.”

Grow Jackson is a 501©3 nonprofit that empowers the community through fresh food, education, and community gardens. Urban Agriculture Intern Workforce Development Program interns are recent high school graduates who will complete the Department of Labor certified Roots of Success Curriculum to earn a Pre-Apprenticeship in Environmental Literacy, which exposes the interns to local STEM job opportunities. Aside from basic labor in the garden, the inters provide education to younger students and individuals in other community programs, as well as delivery of fresh produce grown in local community gardens to food insecure members throughout the community. The interns were employed through Michigan Works! Southeast.

Visit www.TRUECCU.com to learn more about us, our products, and our services. To learn more about Grow Jackson, visit www.GrowJackson.org.

TRUE Community Credit Union Receives Community Enrichment Award

TRUECCU accepted the award at the MCUL Annual Convention & Exposition.

JACKSON, MI, July 9, 2024 – TRUE Community Credit Union is proud to be the recipient of the Michigan Credit Union Foundation (MCUF) Community Enrichment Award. TRUECCU accepted the award during the Michigan Credit Union League (MCUL) Annual Convention & Exposition (AC&E) in June.

The MCUF Community Enrichment Award recognizes a credit union or chapter for one outstanding community impact initiative aimed at improving the financial wellbeing of people, families, businesses, or communities in Michigan. TRUECCU was recognized for partnering with Michigan Saves to create a program that eliminates the use of the credit score for approval or denial of loans for qualified energy saving upgrades, focusing instead on the borrower’s ability to pay.

“We are deeply honored to receive the MCUF Community Enrichment Award," said TRUECCU President and CEO Chrissy Siders. “This recognition underscores our commitment to serving our members and community. It's a testament to the hard work and passion of our team at TRUE Community Credit Union, and we remain steadfast in our mission to cultivate legacy defining moments in the lives of those we serve. Equity is at the heart of our operations, and we are dedicated to ensuring that all members of our community, especially the underserved, have access to the financial resources and support they need to thrive.”

Michigan Saves is a non-profit organization that provides a clean energy lending program that assists homeowners with finding an authorized contractor, an online application for financing, and connecting with a qualified lender. To learn more about Michigan Saves, visit www.MichiganSaves.org.

TRUE Community Credit Union Announces 2024 Scholarship Recipients

Ten scholarships of $1,000 each were awarded

JACKSON, MI, June 4, 2024 – TRUE Community Credit Union announces the recipients of 10 scholarships as part of National Financial Literacy Month.

TRUE Community Credit Union awarded ten students with a $1,000 scholarship each. This year students graduating high school in the 2024 graduating class and students over the age of 23 that have a high school diploma or their GED and are now seeking a degree or returning to complete their degree had the opportunity to apply.

“We were in awe of the number of essays we received this year,” said TRUECCU Chief Community Impact Officer Sarah Ermatinger. “Awarding these scholarships each year is a direct reflection of our commitment to cultivating legacy-defining moments for the people and places we serve and an investment in the future leaders who will drive positive change and innovation.”

Applicants submitted an essay on that asked: “How does Financial Education prepare you for your future, and what educational resources have you used from TRUE Community Credit Union?”

“At TRUE Community Credit Union, we have the opportunity to inspire the pursuit of a life well-lived by empowering the youth and members of the communities we serve with the financial knowledge they need to navigate life events, such as attending college,” said TRUECCU Financial Education Manager Kelly Hatler. “We are pleased to present each of our 10 scholarship recipients with a $1,000 award as they write their life story by pursuing the next steps in their educational journey. Congratulations to all!”

The recipients of the 2024 Scholarships are:

- Elisha Correll, Jackson High School

- Savannah Cushman, Columbia Central High School

- Maxwell Elder, Western High School

- Lily Ellison, Columbia Central High School

- Katherine Gerring, Homeschool

- Kelli Higgins, Jackson High School

- Noah Moore, Columbia Central High School

- Peyton Morrow, Western High School

- Reese Nagy, Lenawee Christian School

- Christian Nykamp, Napoleon High School

TRUE Community Credit Union is dedicated to maintaining 30+ years of serving over 30 schools to promote the Partnership in Education program. TRUE Community embraces the chance to work with youth around the state.

Energage Names TRUE Community Credit Union a Winner of the

2024 Top Workplaces USA

Winners are chosen based solely on employee feedback from over 42,000 organizations.

JACKSON, MI, March 20, 2024 – TRUE Community Credit Union is excited to announce it has earned the 2024 Top Workplaces USA award, issued by Energage, a purpose-driven organization that develops solutions to build and brand Top Workplaces. The Top Workplaces program has a 15-year history of surveying more than 20 million employees and recognizing the top organizations across 60 markets for regional Top Workplaces awards.

“At TRUE CCU, we understand that excellence is achieved when every member of our TRUE family is empowered and valued,” says Chrissy Siders, President and CEO of TRUE Community Credit Union. “This national recognition underscores the unwavering dedication and passion of our employees, whose commitment to excellence and impact fuels our success. Our employees are the heart and soul of our organization, and I am so grateful for our collective desire to cultivate legacy-defining moments for the people and places we serve.”

Top Workplaces USA celebrates organizations with 150 or more employees that have built great cultures. Over 42,000 organizations were invited to participate in the Top Workplaces USA survey. Winners of the Top Workplaces USA list are chosen based solely on employee feedback gathered through an employee engagement survey, issued by Energage.

“Receiving Top Workplaces designation regionally nine times is an honor," says Heather Harback, Chief People Officer at TRUE CCU. “Receiving Top Workplaces designation at the national level for the first time is humbling, and we're grateful for the recognition of the work we've been doing to create an exceptional workplace for our team. Our employee feedback informs these results, so when Top Workplaces says we're at the top nationally, it really is because our employees said so. We are deeply grateful and will continue doing the good work to partner with our employees in their pursuit of a life well-lived.”

Results are calculated by comparing the survey’s research-based statements, including 15 Culture Drivers that are proven to predict high performance against industry benchmarks.

“Earning a Top Workplaces award is a badge of honor for companies, especially because it comes authentically from their employees,” says Eric Rubino, Energage CEO. “That's something to be proud of. In today's market, leaders must ensure they’re allowing employees to have a voice and be heard. That's paramount. Top Workplaces do this, and it pays dividends.”

TRUE CCU serves approximately 80,000 members with 15 branch locations in Jackson, Ingham, Wayne, and Washtenaw counties. By combining cutting-edge technology with personalized service, TRUE CCU continues to be a leader in the industry, focusing on people over profit, process, and product.

###

ABOUT ENERGAGE

Making the world a better place to work together.TM

Energage is a purpose-driven company that helps organizations turn employee feedback into useful business intelligence and credible employer recognition through Top Workplaces. Built on 18 years of culture research and the results from 27 million employees surveyed across more than 70,000 organizations, Energage delivers the most accurate competitive benchmark available. With access to a unique combination of patented analytic tools and expert guidance, Energage customers lead the competition with an engaged workforce and an opportunity to gain recognition for their people-first approach to culture. For more information or to nominate your organization, visit energage.com or topworkplaces.com.

TRUE Community Credit Union Grows Brighter Future for Members

TRUE family welcomes 13,000 new members

JACKSON, MI, January 22, 2024 – TRUE Community Credit Union is excited to announce a successful merger with Parkside Credit Union. As the new year unfolds, the combined credit union is set to provide members with enhanced services, foster deeper community relationships, and continue its commitment of financial excellence.

“We’re delighted to grow the TRUE Community family,” said Chrissy Siders, President and CEO of TRUE Community Credit Union. “The outlook for 2024 is incredibly promising, and we’re grateful to be entrusted to generate financial well-being for so many. We commit our time, talents, and, most importantly, our joyful energy to cultivate legacy-defining moments for all those we serve.”

All employees from both credit unions continue to serve members. As a financially strong organization, TRUE CCU offers opportunities for team members to grow their skill sets and careers.

TRUE CCU now serves approximately 80,000 members with 15 branch locations in Jackson, Ingham, Wayne, and Washtenaw counties. By combining cutting-edge technology with personalized service, TRUE CCU continues to be a leader in the industry, focusing on people over profit, process, and product.

TRUE Community Credit Union Awarded NCUA Pilot Grant

The $100,000 grant will support outreach to credit-invisible populations.

JACKSON, MI, December 13, 2023 – TRUE Community Credit Union is proud have been awarded a $100,000 Community Development Revolving Loan Fund (CDRLF) grant from the National Credit Union Administration. TRUECCU was one of four credit unions in the country to receive a CDRLF pilot grant out of 26 that submitted applications.

“We are profoundly honored to be the recipient of the NCUA Community Development Revolving Loan Fund grant,” said TRUE Community Credit Union Chief Growth and Lending Officer Valerie Moskal. “This significant investment marks a pivotal moment in our journey to partner with, empower, and uplift the communities we serve. With this support, TRUE is poised to forge new pathways of financial inclusion, foster growth, and create a lasting positive impact. We are committed to leveraging this grant to its fullest potential.”

TRUECCU will use the grant to reach and positively impact credit-invisible and underserved borrowers through Michigan Saves, their lending partner that offers low-interest loans for qualified energy-saving upgrades. TRUECCU and Michigan Saves will identify underserved communities for expansion, create marketing and outreach materials to reach the credit-invisible, engage Michigan Save's network of authorized contractors to promote the program, hire a financial health coach to create and deliver adult financial literacy, and provide a small stipend to borrowers who attend financial health coaching sessions to use for late fees or loan payments.

“The NCUA launched this pilot grants initiative to recognize creative ideas among credit unions trying to build membership and expand their reach, especially to people and communities who had little or no access to affordable financial services,” said NCUA Chairman Todd M. Harper. “We found, through the application process, original and forward-looking ideas that could serve as examples for other credit unions. It will be exciting to watch how these grants will help these ideas to mature and take hold.”

Michigan Saves is the nation's first nonprofit green bank that provides a clean energy lending program that assists homeowners with finding an authorized contractor, an online application for financing, and connecting with a qualified lender. To learn more about Michigan Saves, visit www.MichiganSaves.org.

TRUE Community Credit Union Scores NIL Partnership

Local NCAA athlete joins the TRUE team to celebrate community pride.

JACKSON, MI, December 7, 2023 – TRUE Community Credit Union is excited to announce its Name, Image, and Likeness (NIL) partnership with Michigan State University basketball player Carson Cooper. As a Jackson native, Cooper will be instrumental in creating opportunities to showcase TRUECCU’s mission of being true to their community.

“We are thrilled to welcome Carson Cooper to the TRUE family,” said TRUE Community Credit Union President and CEO Chrissy Siders. “We recognize the importance of supporting our own and investing in the future. Having witnessed Carson's growth as an athlete within our community, we are honored to be a part of his legacy-defining moments and to contribute to our community's sense of pride.”

Cooper attended Northwest High School and graduated from IMG Academy. He is currently a sophomore at MSU where he plans to major in business.

TRUECCU has 12 branch locations in Jackson, Ingham, and Washtenaw counties. On January 1, 2024, TRUECCU will join with Parkside Credit Union to offer three branch locations in Wayne County. By combining cutting-edge technology with personalized service, TRUECCU continues to be a leader in the industry that focuses on people over profit, process, and product.

TRUE Community Credit Union Named a Detroit Free Press Winner of

the Michigan Top Workplaces 2023 Award

JACKSON, MI, November 28, 2023 – TRUE Community Credit Union has been awarded a Top Workplaces 2023 honor by Detroit Free Press Top Workplaces. This is the nineth Top Workplaces Award TRUECCU has received in 10 years.

“We are thrilled to be celebrating our ninth year being named a Top Workplace,” said Chrissy Siders, President and CEO of TRUE Community Credit Union. “This recognition celebrates our collective commitment to a workplace culture rooted in collaboration, compassion, and shared success. At TRUE, we understand that excellence is achieved when every member of our TRUE family is empowered and valued. This award is a testament to our ongoing journey of creating lasting legacy-defining moments for our members and employees.”

The list is based solely on employee feedback gathered through a third-party survey administered by employee engagement technology partner Energage LLC. The confidential survey uniquely measures 23 workplace experience indicators critical to the success of any organization.

“We are focused on creating an environment in which people couldn’t imagine working anywhere else,” added Heather Harback, Chief People Officer at TRUE Community Credit Union. “This work requires strong listening, engaging in uncomfortable and necessary conversations, and a deep investment in relational leadership. We’re committed to partnering with our employees in their pursuit of a life well-lived and continue to look for opportunities to display that commitment.”

“Earning a Top Workplaces award is a badge of honor for companies, especially because it comes authentically from their employees,” said Eric Rubino, Energage CEO. “That's something to be proud of. In today's market, leaders must ensure they’re allowing employees to have a voice and be heard. That's paramount. Top Workplaces do this, and it pays dividends.”

TRUECCU has 12 branch locations in Jackson, Ingham, and Washtenaw counties. On January 1, 2024, TRUECCU will join with Parkside Credit Union to offer three branch locations in Wayne County for the convenience of current and prospective members.

TRUE Community Credit Union Receives the Louise Herring Philosophy in Action Award

The award recognizes credit unions that demonstrate the credit union philosophy.

JACKSON, MI, November 21, 2023 – TRUE Community Credit Union is proud to receive the Louise Herring Philosophy in Action Award from the Credit Union National Association.

The Louise Herring Philosophy in Action Award recognizes credit unions that demonstrate the internal application of credit union philosophy to help better financial matters and increase financial education for its members. TRUECCU has demonstrated this philosophy by partnering with Michigan Saves to offer low-interest loans to credit invisible borrowers for qualified energy saving upgrades.

“Our members are the foundation of our purpose, mission, vision, and values, and we are committed to be true to them and the communities we serve,” said Chrissy Siders, President and CEO of TRUE Community Credit Union. “Receiving this honor validates our commitment to value people over profit, process, and product. We will continue to lean into this philosophy by generating financial well-being for all and cultivating legacy-defining moments for those we serve!”

Michigan Saves is a non-profit organization that provides a clean energy lending program that assists homeowners with finding an authorized contractor, an online application for financing, and connecting with a qualified lender. To learn more about Michigan Saves, visit www.MichiganSaves.org.

Parkside Credit Union Members Vote to Join TRUE Community Credit Union

Parkside Credit Union will officially join with TRUECCU on January 1, 2024.

JACKSON, MI – November 16, 2023 – Following a vote that concluded on November 15, Parkside Credit Union members have voted "Yes" to join TRUE Community Credit Union, effective January 1, 2024. This merger will bring together the collective strengths of both credit unions, resulting in expanded services, increased opportunity, and enhanced convenience for members.

The decision to merge with TRUECCU was made after careful consideration and extensive discussions among the Boards and leadership teams of both credit unions. By joining forces, Parkside Credit Union and TRUECCU aim to create a more robust organization that can better serve the evolving needs of their members.

“To say we’re excited to welcome Parkside Credit Union members to the TRUE Community family is an understatement,” said Chrissy Siders, President and CEO of TRUE Community Credit Union. “Together, as TRUE Community Credit Union, we stand, ready to empower and uplift our members, our employees, our communities, and our collective future. We are grateful to be a trusted partner and for the opportunities in front of us to generate financial well-being for all by cultivating legacy-defining moments for those we serve.”

The merger between Parkside Credit Union and TRUECCU is a testament to their shared commitment to provide exceptional financial services and support to the members, teams, and communities they serve.

“We are thrilled that our members have voted in favor of this merger,” said Janet Thompson, President and CEO of Parkside Credit Union. “This successful vote is a testament to the unity and strength of our credit union family. Together, we look forward to a bright financial future of combined resources and expertise to offer a broader range of financial solutions to members.”

Parkside Credit Union members can look forward to an increased variety of products and services, enhanced technology solutions, and an extended branch network. After the merger is complete, TRUECCU will add three branch locations in Wayne County to its 12-branch roster within Jackson, Ingham, and Washtenaw counties.

TRUE Community Credit Union's CEO Stands with Andy’s Place in aHeartfelt Commitment to

Address Addiction in Our Community

SEPTEMBER 14TH, 2023- The Jackson Area Transportation Authority is proud to announce TRUE Community CreditUnion's donation of $2,000 to provide bus passes to residents of Andy’s Place, arevolutionary recovery housing project in Jackson which addresses substance abuserecovery holistically.

SEPTEMBER 14TH, 2023- The Jackson Area Transportation Authority is proud to announce TRUE Community CreditUnion's donation of $2,000 to provide bus passes to residents of Andy’s Place, arevolutionary recovery housing project in Jackson which addresses substance abuserecovery holistically.

TRUE COMMUNITY CREDIT UNION AND PARKSIDE CREDIT UNION

ANNOUNCE MERGER PLANS

Merger represents significant opportunities for both credit unions.

JACKSON, MI – July 26, 2023- TRUE Community Credit Union and Parkside Credit Union, two well-established financial institutions known for their dedication to serving their members and communities for 70 years, are pleased to announce their intention to merge. The merger will produce a stronger, more comprehensive financial institution that will offer additional services, increased convenience, and ongoing support to members.

The merger represents a significant opportunity for both credit unions. By combining their strengths and resources, TRUE Community Credit Union and Parkside Credit Union will offer an even wider range of products and services, enhanced technology, and an expanded branch network to meet the evolving needs of their members.

The leadership of both credit unions express confidence that the merger will bring substantial benefits to their members, employees, and communities.

Chrissy Siders, President and CEO of TRUE Community Credit Union stated, "We are so excited to join forces with Parkside Credit Union as we embark on this transformative journey. Together, we embrace a shared vision, combining our strengths and resources to create an unparalleled financial experience that will stand as a testament to our unwavering commitment to our members, our communities, and our teams."

Janet Thompson, President and CEO of Parkside Credit Union, said, "Our partnership with TRUE Community Credit Union will build a brighter future for both our members and our employees. The alignment of our strategies and cultures as well as a shared vision makes this an ideal collaboration, and we are excited to write the next chapter in our combined credit union’s legacy together."

TRUE Community Credit Union, headquartered in Jackson, has twelve branch locations in Jackson, Ingham, and Washtenaw counties. Parkside Credit Union's headquarters in Westland, offers three branch locations in Wayne County. The combined credit union will retain the name and brand of TRUE Community Credit Union with its mission to cultivate legacy defining moments for the people and places they serve for generations to come by empowering members to achieve their financial goals.

TRUE Community Credit Union and Parkside Credit Union will work closely with regulatory authorities and stakeholders to obtain the necessary approvals, finalizing the merger on January 1, 2024.

TRUE Community Credit Union Partners with Nuestra Comunidad to Support Scholarship Fund for Hispanic Students

JACKSON, MI, July 6, 2023 – Nuestra Comunidad is delighted to announce that TRUE Community Credit Union has pledged its support to the Nuestra Comunidad scholarship fund, benefiting Hispanic students in the Jackson community. TRUE Community Credit Union’s financial support and resources will go specifically toward the scholarship fund that will empower and uplift Hispanic students, helping them pursue their academic goals.

“We take great pride in our support of Nuestra Comunidad and our contribution towards the establishment of the scholarship fund. By investing in the educational aspirations of Hispanic students, we are investing in the future of our community and cultivating legacy defining moments that will shape the people and places we serve,” said Chrissy Siders, President and CEO of TRUE Community Credit Union.

Leticia Albarran, Co-Founder and Chair of the Board of Directors for Nuestra Comunidad, said, “Partnering with TRUE Community Credit Union is momentous for us at Nuestra Comunidad and a win for the community. Witnessing their dedication and actively taking a role in uplifting the Jackson Hispanic/Latino community is inspiring and aligns with our mission of providing accessibility and resources to Hispanic/Latino students for higher education. Their generosity is going to have a lasting impact and make significant changes in students’ lives for decades to come, as it impacts the family unit, not just an individual.”

In addition, the 2023 Jackson Hispanic Heritage Festival will generate additional resources for the scholarship fund and Nuestra Comunidad. The festival is an annual celebration that brings together communities and showcases Hispanic culture's vibrant traditions, music, dance, art, and cuisine. It will take place on September 16 from 12 to 9:30 p.m. in Downtown Jackson. This year, attendees may take part in the fun while contributing to the Nuestra Comunidad scholarship fund via ticket sales, sponsorships, and donations.

For more information about the scholarship fund please visit: https://docs.google.com/forms/d/e/1FAIpQLSdBlqonR7VtmXxJiJWNUVUveGqgWJ4W-tqM7ifLxUBNvcWKXQ/viewform

TRUE Community Credit Union and American 1 Credit Union Partner for Police Week

The funds raised by the credit unions will be donated to Police Week Michigan Fund.

JACKSON, MI, May 15, 2023 – TRUE Community Credit Union and American 1 Credit Union are partnering to help raise funds for Police Week Michigan. The Police Week Michigan Fund celebrates law enforcement throughout our state, educates the public on law enforcement programs, and supports law enforcement through other programs.

"National Police week is a collaborative effort of many organizations dedicated to honoring America’s law enforcement community and we can’t think of a better way to participate than collaborating with our friends at American 1 Credit Union,” said TRUECCU President and CEO Chrissy Siders. “We believe it is critical to step into a space of honoring, remembering, and supporting law enforcement in our community and are grateful for the sacrifice and selflessness shown by the law enforcement community each day. Our neighborhoods and credit unions are better because of their presence!”

Police Week Michigan runs from Sunday, May 14 through Saturday, May 20. On Friday, May 19, team members of both credit unions will wear blue shirts and jeans in support of our law enforcement members.

"We have a responsibility to the communities we serve, and our continued partnership with TRUE Community Credit Union showcases our priority to do the right thing – no matter how unique the partnership,” said Martha Fuerstenau, President and CEO of American 1 Credit Union. “We feel strongly about supporting the police that protect our communities, and the funds raised from Police Week Michigan is used to educate the public and support law enforcement programs.”

TRUE Community Credit Union Wins Two National Top Workplaces Recognition Awards

TRUECCU recognized for Innovation and Work-Life Flexibility

JACKSON, MI, May 4, 2023 – The National Top Workplaces, which uses annual engagement survey data to grant honors to companies across the country doing exceptionally well in specific areas, announced its quarterly awards recipients. TRUE Community Credit Union has been honored to receive two National Top Workplace Awards for Innovation and Work-Life Flexibility.

“Recognition on a national level in the company of so many great organizations is something special. It affirms for us the work we’re doing is directly supporting the culture we want for our employees,” said TRUECCU Chief People Officer Heather Harback. “We promote a workplace where innovation is fueled through the ideas of an empowered group of individuals and where each person is encouraged to ask for what they need to be successful in all areas of their life.”

The Top Workplaces for Innovation Award recognizes organizations that have created a culture where new ideas are encouraged, which helps employees to reach their full potential and benefits performance. The Top Workplaces for Work-Life Flexibility Award recognizes organizations that have built a culture that enables employees to meet the demands of their personal lives while maintaining high performance.

TRUE has succeeded in these areas in various ways. Examples include upgrading their Digital Banking platform, creating new positions that support innovation and the capacity to innovate, leaning into team members for diverse voices and perspectives to drive change in the workplace, providing more opportunities for hybrid and remote work in areas that can support it, and providing support and flexibility through the pandemic and beyond in order for team members to care for themselves and their families.

“I continue to be blown away by the entire TRUE Community Credit Union Team, and their tireless efforts day in and day out to be TRUE to our members, TRUE to our communities, and TRUE to each other,” said TRUECCU President and CEO Chrissy Siders. “We are so humbled to receive these National Top Workplaces Awards. Attaining this honor validates our commitment to value people over profit, process, and product. Our passion for people runs deep and while we always have much work to do, I am grateful our employees feel seen, heard, and recognized for their efforts. The employee engagement survey is just one way that we flex our value of two-way feedback, graciously welcomed and respectfully given. However, we don’t want to rest on our laurels. We can’t wait to dig into the valuable feedback as we continue to respond, invest, serve, and engage our TRUE family!”

Visit www.TRUECCU.com to learn more about TRUE, its products and services, and the culture that allows them to provide the best service to their members.

TRUE Community Credit Union Celebrates its 70th Birthday

JACKSON, MI, May 1, 2023 – TRUE Community Credit Union was delighted to celebrate its 70th birthday on Friday, April 28.

TRUE Community provided cupcakes and party favors to members who visited any of its 12 branches, and is hosting a month-long giveaway of $70 to 70 winners. The drawing is open from April 24 through May 21, with winners announced on Monday, May 22.

“We are so excited to be celebrating 70 years of being TRUE to our members, TRUE to our communities, and TRUE to each other!” said TRUECCU President and CEO Chrissy Siders. “I am so grateful to that small committee of individuals that met 70 years ago to form a financial cooperative to provide members with a safe, convenient place to save, and a source of credit, when needed, at or better than competitor’s rates. I am also grateful for all of the people that have come and gone, and still remain, over the past 70 years, who continue to provide that same vision, plus so much more! We can’t wait to continue cultivating legacy-defining moments for countless years to come!”

What began in 1953 as the financial cooperative Jackson Consumers Power Employees Federal Credit Union has evolved to serve its changing membership and has become one of the strongest and financially healthy credit unions in the state. In the fall of 2020, the credit union changed from a federally chartered to a state-chartered credit union to expand its membership to anyone that lives, works, worships, or attends school in Michigan and became known as CP Financial Credit Union.

More growth proceeded as CP merged with Washtenaw Federal Credit Union in January 2021 to become TRUE Community Credit Union. Today the credit union serves more than 65,000 members with $700 million in assets and 12 branch locations in Jackson, Ingham, and Washtenaw counties, and brings a combined 138 years of serving members, communities, and employees.

Visit www.TRUECCU.com to learn more about TRUE, its products and services, and the culture that allows them to provide the best service to their members.

TRUE Community Credit Union Announces 2023 Scholarship Award Winners

Five winners will receive $1,000 each for their postsecondary education

JACKSON, MI, April 24, 2023 – TRUE Community Credit Union is pleased to announce the recipients of five scholarships. The scholarships are awarded each year as part of TRUE Community Credit Union’s education program.

This year, five students were each awarded a $1,000 scholarship, paid to the college, university, or technical school they are attending in the fall. The winners are:

- Alivia Smith from Jackson will be attending Jackson College to study Business.

- Philip Coughlin from Brooklyn will be attending Northern Michigan University to study Cybersecurity.

- Mit Foley from Saginaw will be attending Michigan State University to study Human Biology.

- Keegan Schoendorf from Michigan Center will be attending Michigan State University to study Nursing.

- Karson Schroeder from Jackson will be attending Spring Arbor University to study Broadcasting.

Both traditional students graduating in 2023 and non-traditional students over the age of 25 with a high school diploma or GED seeking a degree or return to complete a degree were eligible for the scholarship. TRUE Community Credit Union embraces the chance to work with youth around the state and is dedicated to promoting the Partnership in Education program.

Congratulations to the 2023 TRUE Community scholarship winners!

TRUE Community Credit Union Hires Vice President of Digital Transformation

The Digital Transformation team will drive our digital-first initiatives

JACKSON, MI, April 13, 2023 – TRUE Community Credit Union is excited to announce the addition Jonathan Beard as Vice President of Digital Transformation.

Beard says, “I am very excited to join the TRUE Community Credit Union team as I think we are at a key point where we can realize tremendous benefits for our members by leveraging cutting edge digital technology. We will be better able to serve them where they are and help them live better lives as their preferred financial institution partners. Whether this means using emerging artificial intelligence techniques or iterating on the latest fintech innovations, our objective is to create a world-class experience for our members.”

With over twenty years of professional software development experience, Beard and the Digital Transformation team will design and execute the credit union’s digital strategy. This includes development and execution of a high-impact digital-first vision with product and service innovation and an enhanced member experience.

“Jon brings a vast array of experience leading digital transformation within legacy systems," says Jason Matley, TRUECCU Executive Vice President and Chief Strategy Officer. “His vision and his passion for innovation will be instrumental in ensuring the credit union’s success in the coming years. Adding Jon to the team will allow for a level of agility in the digital space that enables our amazing team to serve our members as they navigate their legacy-defining moments.”

Visit www.TRUECCU.com to learn more about us, our products, and our services.

TRUE Community Credit Union Leader Recognized with ATHENA Leadership Award

Presented to leaders across professional sectors, the Athena Leadership Award’s rich history, international scope, and focus on mentorship distinguishes it as one of the most prestigious leadership awards one can receive.

Interviews

Check out our lasted interviews!

TRUE Community Credit Union's President/CEO, Chrissy Siders, was featured as a guest on the Teaching Tax Flow podcast, where she discussed the key distinctions between credit unions and traditional banks.

Member Survey

TRUE Community Credit Union will randomly survey members weekly to help us gauge member satisfaction. This survey,

Please note account information is not needed for the survey.

{endAccordion}

New interchange bill will hurt consumers and credit unions